Cross-Border eCommerce Logistics:

Strengthening the Airport-Airline Relationship.

“This article covers the development of cross-border eCommerce growth and the impact on airlines and airports. The evolving growth has put tremendous pressure on airlines and airports to adapt their processes, sales channels, and warehouses. The demand for air cargo movements, stimulated by cross-border eCommerce, is changing the logistics game rules by emphasizing on faster delivery speeds, customer-centric services, tracking at a parcel level, and CO2 reduction programs.”

Key Messages

- Cross-Border eCommerce is pushing the development of airports.

- eCommerce was the main driver for growth during the COVID-19 crisis.

- Airports and Airlines need to work together, creating synergies.

- Regional Airports can gain market share due to big cargo airports capacity constraints.

Cross-Border eCommerce logistics is playing a substantial role in improving the effectiveness of the supply chains, by increasing the efficiency of freight operations, and boosting global freight volumes. But not only this – the development of cross-border eCommerce trade creates a considerable market opportunity for developing airport cargo facilities and increased business airline and freight forwarders operations. Airports,the infrastructure providers for the air cargo activities, are actively targeting two groups: the airlines and air freight forwarders. The air freight forwarders, being a key player in the air freight process, usually consolidate parcels received from different shippers for specific destinations and airlines. Acknowledging the importance of a strong business relationship between the three mentioned parties, as well as having a vision on how to succeed is of vital importance. With that, is cross-border eCommerce bringing airlines and airports close to innovation? How should all parties involved manage the eCommerce growth? What are the success factors for a successful strategy? – these are just a few questions which we will try to cover in this article.

Airports – Airlines: Investing to Ensure Growth

According to Aviation Business News, eCommerce was a key driver for air cargo during the COVID-19 crisis. To cope with the demand, all parties must adapt and change the supply chain solutions, specifically for eCommerce and capture this valued segment. Recently, DHL eCommerce released a report focusing on the eCommerce Supply Chain and how to overcome growing pains. For B2C, 65% of the surveyed companies are planning to change how to fulfill an order in the next 3-5 years and choosing 2+ methods:

- Such as delivering from a dedicated e-commerce facility with a dedicated inventory for online orders

- from a multi-channel facility which handles online orders and traditional orders from a combined inventory.

For B2B, the number is slightly higher, 79% of the companies will choose 2+ methods to fulfill orders.

For airports, the increase in the express business is putting pressure on optimizing the processes. Leipzig/Halle Airport (LEJ) is one of the leading airports and biggest cargo airports in Germany and Europe. The eCommerce parcels coming on routes from China and the overall goods from the Asia-Pacific offer a great business potential for further development. For LEJ, the cross-border eCommerce volumes from the last 13 years are supporting the ongoing development of the airport. This was recently accelerated, due to the COVID-19 pandemic. In the first seven months of 2021, LEJ handled almost 900,000 tones, 18.9% than in the first seven months of 2020. In 2020, the airport handled around 1.4 million tons of cargo, setting new high records. The expected growth in volumes brings further facilities development, thus creating direct and indirect jobs in different areas, boosting the economic growth of the region.

Taking LEJ as an example, airports looking to capture market share need to offer optimal conditions such as implementing a multi-modal transport strategy. By ensuring the connectivity with highways, railway networks, and in the best-case scenario connections direct to seaports to ensure full connectivity to support the volume flows. Joining forces, airports and airlines can create efficient logistics systems and set facilities as freight multimodal hubs. Investing together in marketing, sales, business, and personnel development also need to be part of the equation. Together with offering conditions for cross-border eCommerce service providers, freight forwarders, or consolidators to develop and be part of the story.

Without plane manufacturers, nothing could fly. Without airlines, planes wouldn’t be as prominent as they are. Without airports, there would be nothing.

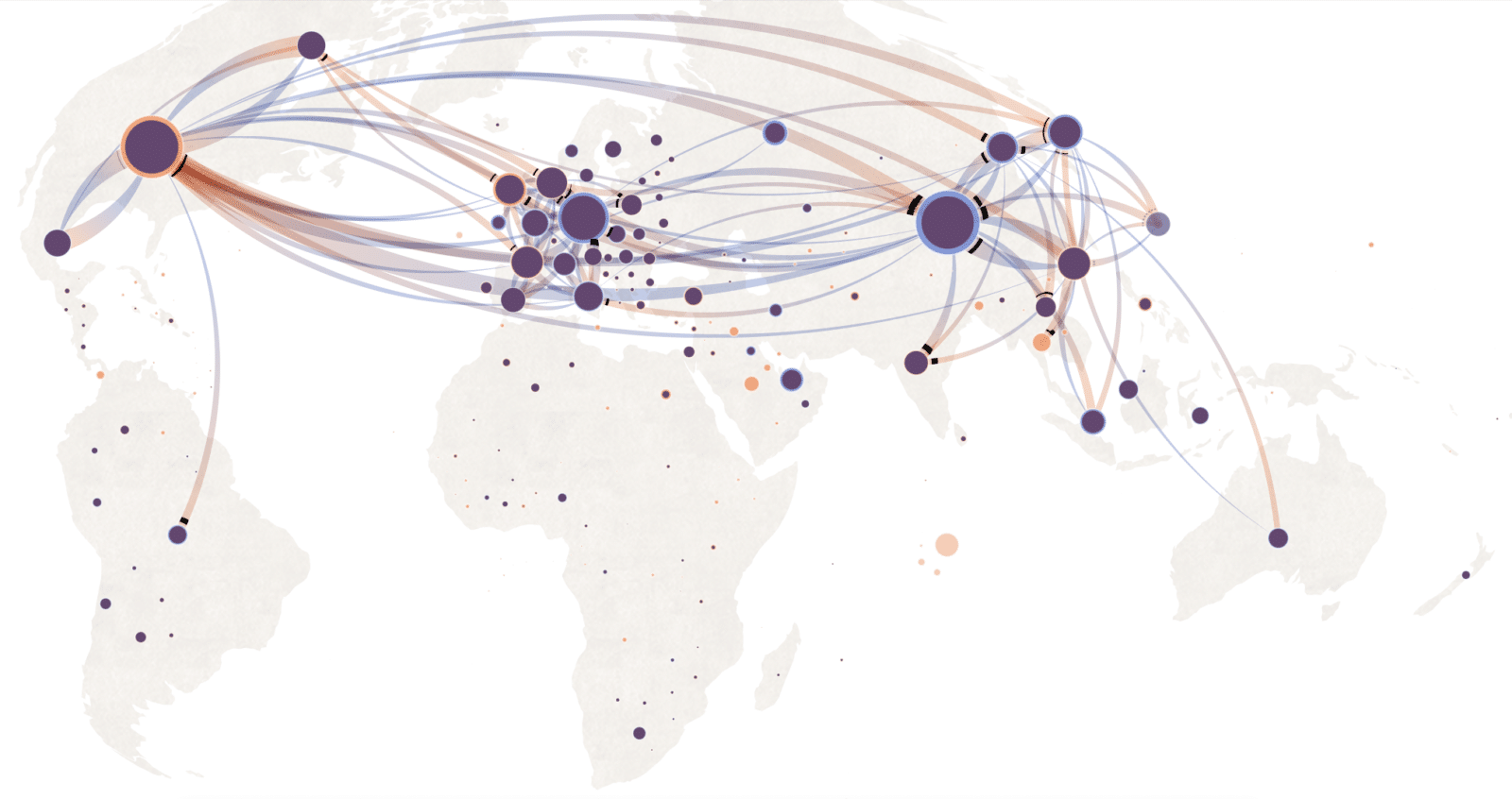

Chart 1. The world map of global trade flows. // Source: Flows and Tolls, 2021 (Orange – Imports, Purple – Exports)

Supply chains have become ever-more challenging, especially during the current COVID-19 pandemic. Lower capacities and higher demands are by far the toughest of challenges to conquer. Whoever has the best routes, capacities, deals, and technology dominate the eCommerce market. The dominating eCommerce figure, Alibaba Group, has invested heavily in the Liège Airport, located in Belgium. In 2019, the airport planned a new expansion, leasing 222,000 square meters to build a smart logistics hub, with an initial investment of 75 million euros. The strategy is to offer SMEs to manage efficiently the exports and boost the cross-border eCommerce plans. Having in mind the Chinese growth, Liege Airport has focused on creating a proper logistics infrastructure and using technological innovation. Understanding the importance of a multi-modal hub, Liege is the final stop of the famous Chinese freight train, departing from Zhengzhou twice a week.

Are regional airports the solution?

But happy situations are not everywhere, and this is where secondary airports can take the lead. As big cargo airports are facing capacity bottlenecks, there is a huge opportunity ahead for regional airports. Congestion at leading cargo airports resulting in outbound and inbound gridlocks and higher costs can be reasons for switching to regional airports. We believe that airports that are not leading cargo facilities will choose to invest in capacity (both inside and outside) to create opportunities to attract demand in the future. Airports need to make sure there is a suitable runway length for bigger cargo aircraft, apron facilities that can be expanded, land availability for big logistics facilities, low passengers’ volumes to ensure the airport is not slot restricted, accessibility to major road infrastructure, sufficient labor supply, and good weather conditions to allow operations in all conditions.

Choose heyworld.

In this ever-growing industry, heyworld is partnered together with both Frankfurt International Airport and the Lufthansa Group. By giving customers the chance of moving their cargo through the leading German cargo airport, the expansive technology, and routes help move cargo quicker and more efficiently.

About heyworld.

heyworld GmbH was established in 2019, as a 100% subsidiary of Lufthansa Cargo, specialized in cross-border, eCommerce logistics. heyworld translates airfreight processes and standards into the eCommerce world (ex. conversion of chargeable weight into a parcel level-based pricing scheme). We combine airfreight, eCommerce, and logistics know-how, working with a modular service, from first mile, middle mile (air freight) to end mile. We are well Integrated into Lufthansa handling process, and connected to all service providers and process steps via API integration.

You might also be interested in …